Financial Planning

Born out of the bond between wealth management and life planning, we are devoted to helping individuals erase life’s uncertainties.

It's good to know, you know?

Whether you’re investing for your future retirement or living it now, there are some important questions you need answered. Questions like: How much money will you need for your future self? When will you need it? How long will it last? Is there a better way?

Once you know the answers to all of these questions, your challenge will become clear: Just how – exactly – you are going to make it happen. Fortunately, there’s a plan for that. And we’re here to give you that plan.

ZeroCelsius

Wealth Studio

Private Wealth Management

($1M Minimum)

Designed for individuals, committed couples, and families with investable savings over $1M in one or multiple accounts (including Trust, 401K, 403B, and IRA accounts).

Personalized, one-on-one financial planning and investment management.

Offering highly personalized sophisticated investment strategies.

Perfect for those who may require additional investing support (ie: employer 401(k), 403(b), etc.) or sophisticated wealth management expertise.

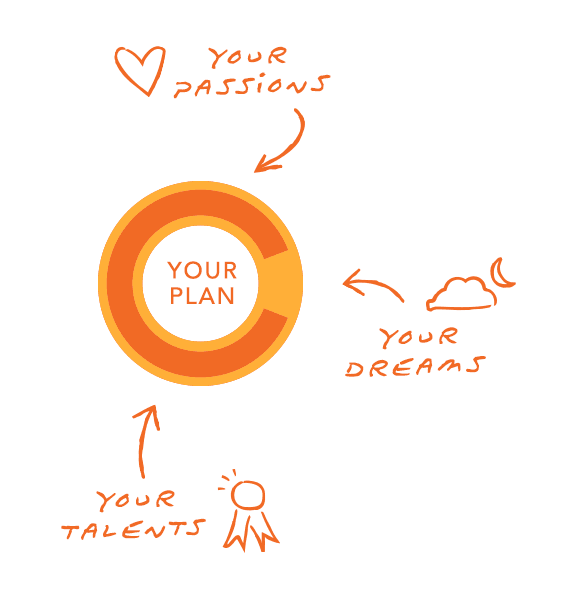

Find Your Inner Cool

At ZeroCelsius Wealth Studio, we recognize and value your individual dreams, talents, and passions. And together, with our clients – scratch that – our friends, we design financial plans and investment portfolios built around those things that matter most.

If your financial plan and investment portfolio is designed around the things most important to you, you’ll be more likely to stick to it…to the end.

We pride ourselves on bringing financial plans and portfolios to life in creative and fascinating ways.

We’ll lay out your “Road to Change” for you. We’ll arm you with the strategies, tactics and tools you’ll need. And we’ll design a personal wealth monitor so you know whether or not you’re on track along the way. You want to get there? We can show you how it’s done and we’re with you every step of the way.

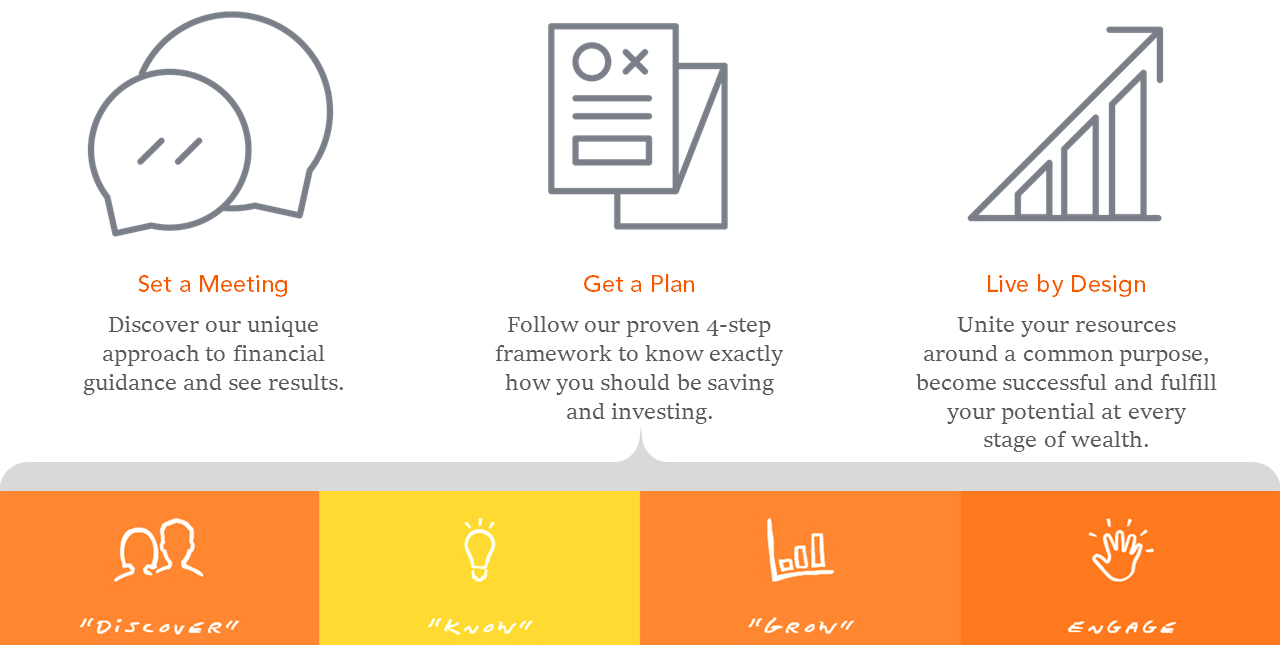

Three Sessions, One Purpose℠

Our 4-step plan is designed to help you re-define and re-direct the rest of your life story. This unique process is spread across 3 studio Sessions, but centered around 1 Purpose.

Why Should I Hire a Financial Advisor?

I’m looking at my clients’ money profile and I see it: a retirement plan account opened through a robo platform. This fact is not surprising, I had previously discussed this with my client. They wanted to try something different and the investment costs were much lower starting out. In this case, the investments are passive, which I explained meant the investments seek to mimic an index and the only rebalancing expected might be once or twice a year.

I’m looking at my clients’ money profile and I see it: a retirement plan account opened through a robo platform. This fact is not surprising, I had previously discussed this with my client. They wanted to try something different and the investment costs were much lower starting out. In this case, the investments are passive, which I explained meant the investments seek to mimic an index and the only rebalancing expected might be once or twice a year.

There won’t be proactive changes if their personal financial situation changes, or if their tolerance is different than what they initially thought. But as my client stated, “there are no financial advisor fees for the first six months, so why not give them a shot?” The use of the word “free” makes me think of the popular economic phrase “there’s no such thing as a free lunch,” but as an advisor, I work with a lot of different partners and I also know my client enough to understand they are set on their decision and so I make a note of the investment and end the conversation.

As an advisor, we get tasked with showing someone why they should pay us to give them advice. If clients can do it all themselves or hire a computer to invest, what is the true value of having a financial advisor? Is it really worth it?

To become advisors, we educate ourselves. There are numerous hours of schooling, readings and trial and error. Practice makes masters, and because we make more financial decisions in one year than one single person will make in a lifetime. After a while, some knowledge becomes innate.

We know time in the market is more important than timing the market. We also know there are certain money scripts and financial behaviors which make it difficult for investors to make objective decisions. Clients’ risk profiles change depending on market conditions, and we know we cannot control what the market does, but we can control how we react to it.

To create the path to living your life by design, you need a plan. This is why it is important to work with an advisor who uses personal financial planning along with investment allocation. For the trust and confidence our clients place in us, we provide a combination of the above factors with the knowledge of you: Knowing your goals and objectives. Knowing whether or not the account you opened is to fund your daughter’s wedding or your own long term care. Knowing your ideal retirement dream would be to play golf five days a week or finally open your own business.

For any other profession, we expect to pay for the services we are provided. If we have an attorney prepare a contract we know they will likely bill by the hour. At our annual check-up, our family practitioner may order tests to rule out certain conditions. These professionals have a duty or an oath to do what is best for you. We trust them and trust their knowledge.

Advisors work in a similar fashion. We truly care about the financial and personal well-being of our clients. Because we know you, and your family; we are objective and subjective. We can make decisions on your best interest the same way you can, the only difference is we have the ability to step back and choose to take what is personal out of the equation or when the case pops up, to add what is personal back in.

A few weeks after my client and I had the discussion to open the account at the robo platform, I realized the account was titled as an additional retirement plan. Because the robo firm didn’t know my client had a separate retirement plan under their business already established, they allowed them to open an account with the wrong title. My client had two retirement plans under their name, which disqualified any tax deduction for money funded during that year. Luckily, we do financial planning for all of our clients, so we caught the error prior to year-end and working with her CPA team, we corrected the issue. But “the free lunch” ended up costing my client their most precious resource: time.

Because I have a commitment to education, I appreciate my clients who care enough about their personal situation to do their research, or who may use a robo platform to dip their feet in to check the water’s temperature. But, just because I type in a few symptoms in WebMD does not mean I should diagnose myself. Most client situations are unique, whether they are getting started with investing or have been doing it for a long time.

Next time you are wondering about the value of a financial advisor, ask yourself: How much is your time worth? Would you prefer to spend countless hours researching mutual funds or equities, or rather go out on a bike ride in the spring? Will you truly feel confident to place your family’s legacy in the hands of a robo platform, or would you like to call a person just like you? A person who has helped you build a personal financial plan to live your life by design and not by default. An advisor who you are confident in, who you trust, who understands you, and who always has your best interest at heart.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns.

Back 2 Basics

The good news is that American households have a total net worth of $85.2 trillion. The bad news is that most families are still behind where they were financially in 2007. In a recent survey, over half of Americans said they had less than $1,000 in their checking and savings accounts combined.